Choosing the right auto insurance in Texas can feel overwhelming because there are so many options. Every provider offers different coverage, costs, and benefits. Texans need to know what factors matter most before making a decision. By understanding the basics, drivers can protect themselves and their vehicles better. Comparing the top providers can help you find a plan that fits your needs and budget. Knowing what to look for saves time and money in the long run. Whether you drive in busy Houston or on rural roads, the right insurance matters. With clear information, you can feel confident about your insurance choice.

Key Factors to Consider When Choosing Texas Car Insurance

When shopping for auto insurance in Texas, it is essential to look at coverage options. Many drivers only consider the minimum liability required by the state, but higher coverage can offer more protection. Companies also offer extra features such as roadside assistance and rental car reimbursement, which can prove valuable after an accident. Every driver should evaluate their risk level and driving habits to determine how much coverage they truly need. Some providers have better reputations for handling claims efficiently, so reading reviews can help you spot the best ones.

Another important factor is customer service quality. Friendly, accessible support can make a big difference after an accident or during stressful times. Many companies now offer mobile apps and online claim filing, which makes the process smoother. Comparing customer satisfaction scores across companies can shed light on how helpful they are in real situations. Often, local Texas agents provide personalized support, so finding a provider with a strong community presence could be beneficial. Excellent customer service can help you feel more secure about your policy.

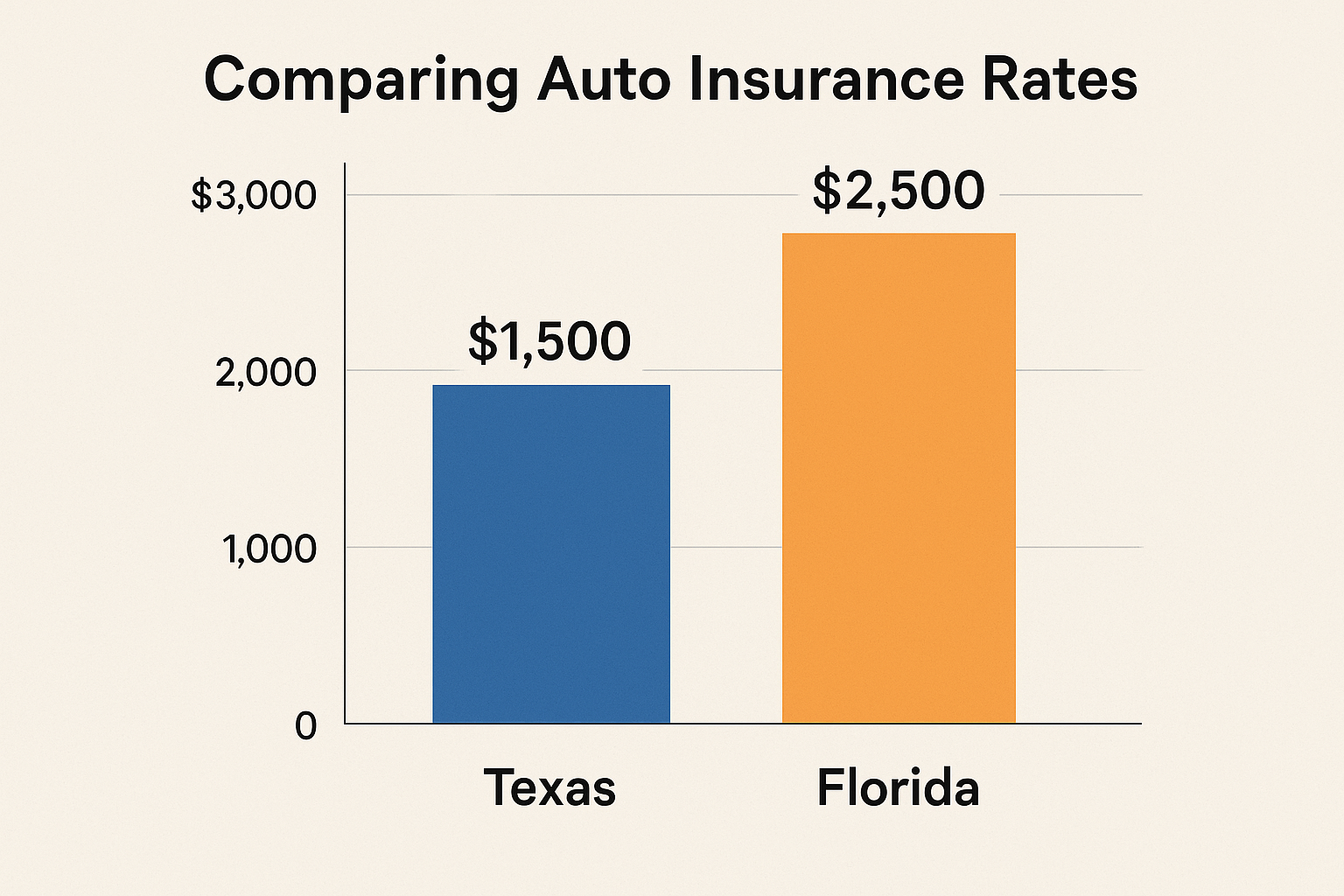

Price should never be the only factor, but it is a major consideration for many Texans. Each company uses its own formula to calculate premiums, so rates can vary widely. Shopping around and getting quotes from several providers is smart. Factors such as your age, driving record, vehicle type, and even your ZIP code can affect your rate. It helps to review your options every year since prices and discounts can change. By weighing price with coverage and service, you can make a smart and informed decision.

Comparing Coverage Options Among Top Texas Providers

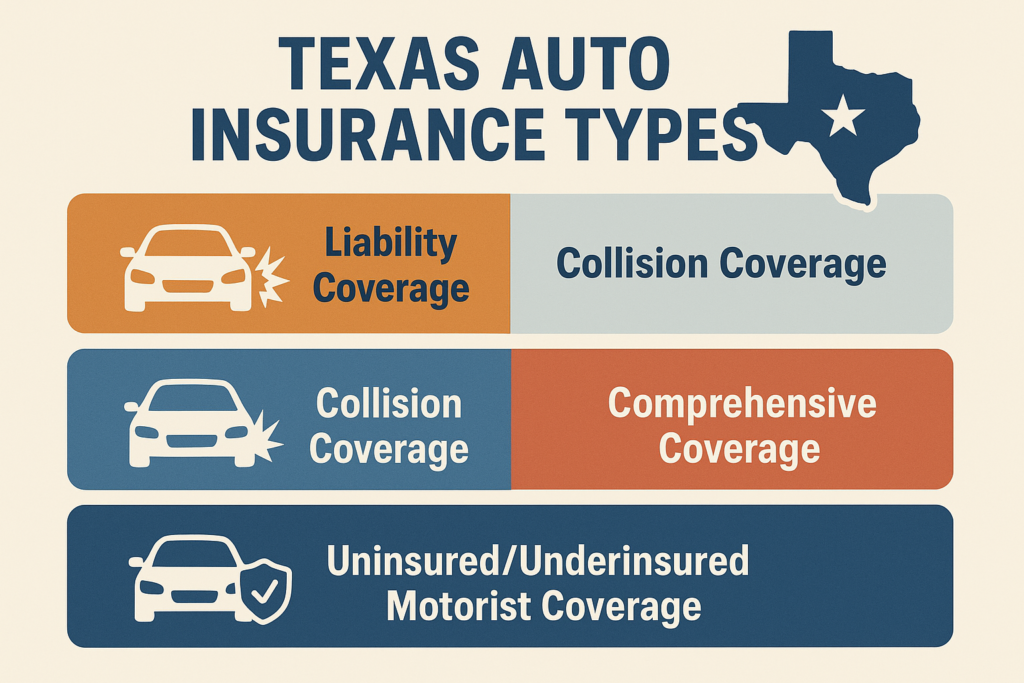

Top Texas auto insurance companies offer a range of coverage types. Most provide basic liability, but you will also find comprehensive, collision, and uninsured motorist options. Some insurers, like State Farm and Allstate, include additional perks such as accident forgiveness or new car replacement. Because not all companies offer the same extras, you should compare each policy carefully. Optional coverage, such as roadside assistance or gap insurance, can make a big difference after an accident.

Different providers may also focus on certain customer groups. For example, USAA serves military families with specialized policies and unique benefits. GEICO is known for affordable coverage and quick online services, while Progressive offers customizable plans and discounts for safe drivers. By comparing the strengths of each company, you can find unique features that suit your situation. Many Texas drivers prefer carriers with flexible options for both policy add-ons and payment schedules. When comparing, always check for restrictions or requirements that could affect your coverage.

Besides the coverage types, policy limits, and deductibles play a crucial role in your protection. Higher limits provide more financial security but often come with higher premiums. Deductible amounts also affect your out-of-pocket costs if you file a claim. Because every company sets different limits and deductible options, you should review each offer with care. Asking about bundling options for home and auto insurance can save money and add convenience. Ultimately, understanding the fine print ensures you get the protection you need without surprises.

Analyzing Costs and Discounts Across Major Insurers

Car insurance costs in Texas depend on many factors, including age, driving history, car model, and even your credit score. Some companies weigh these factors more heavily than others, resulting in price differences for the same coverage. For instance, younger drivers may find better rates with companies known for student discounts, while experienced drivers might benefit from loyalty programs. By gathering quotes from at least three different insurers, you can spot the best deal for your situation. Comparing these estimates side by side helps eliminate overpriced options.

Discounts can greatly reduce your auto insurance bill, so it is important to ask about every possible saving. Many companies reward safe driving, multiple policies, good grades for students, or even vehicles with safety features. Texas drivers often qualify for discounts by taking defensive driving courses or paying their premiums in full. Some insurers offer programs that track your driving habits and provide additional discounts for cautious behavior. By choosing a provider with generous discount options, you can keep your premiums affordable without sacrificing coverage.

It helps to review how each insurer handles rate increases and renewals. Some companies offer “rate lock” features or accident forgiveness, which can prevent your rates from spiking after a claim. Others reward long-term customers with loyalty discounts. Always check if your quote includes all possible discounts and if you qualify for additional savings over time. Regularly comparing rates and discounts ensures you keep getting the best value as your needs change. Asking for a detailed explanation of your quote helps you avoid hidden fees or coverage gaps.

Making the Best Choice for Your Texas Auto Insurance Needs

Choosing the right auto insurance in Texas means balancing coverage, cost, and customer service. Every driver should start by listing priorities, such as low deductibles or specific policy add-ons. Next, gathering quotes from several top-rated providers helps compare options more effectively. You should also read customer reviews and ask friends or family about their experiences. Local agents can provide valuable insights based on your area and driving habits. Making a checklist of must-haves helps keep the decision process organized.

Understanding how claims are handled is just as important as the price. Fast and fair claims service can make a big difference after an accident. Some companies process claims online, while others still use traditional methods. By considering how easy it is to file and track a claim, you avoid unnecessary stress later. Checking customer satisfaction ratings can also give you peace of mind. Many Texas drivers appreciate insurers that offer flexible payment options or 24/7 customer support.

Finally, reviewing your policy every year ensures your coverage still meets your needs. Life changes, such as buying a new car or moving to a different city, can affect your rates and required coverage. Staying in contact with your agent and asking questions about new discounts or policy updates keeps you informed. Comparing policies regularly helps you spot better options and avoid paying too much. By staying proactive, you make sure your auto insurance remains a good fit, no matter how your life changes.

Conclusion

Finding the right Texas auto insurance does not have to be complicated. By focusing on coverage, cost, and customer service, you can confidently narrow down your options. Comparing the top providers helps you understand what makes each one unique, so you find the best match for your needs. Seeking out discounts and carefully reading each policy ensures you get the most value for your money. Asking questions and talking to local agents can provide extra reassurance and helpful advice. With so many choices available, it pays to be thorough and patient in your research. Your driving history, car model, and personal preferences all play a role, so your choice should reflect your unique situation.