Owning a boat in Texas offers plenty of exciting opportunities to explore lakes, rivers, and the Gulf Coast. However, protecting your investment is just as important as enjoying it. Boat Insurance Options for Texas helps shield you from costly accidents, unexpected weather, and other risks on the water. While not every boat owner considers insurance necessary, understanding your options can bring peace of mind. Making smart insurance choices allows you to relax and focus on your time outdoors. Before setting sail, every Texas boat owner should know why coverage matters and how to choose the right policy. With a little research, you can protect both your boat and your wallet with Boat Insurance Options for Texas.

Why Boat Insurance Matters for Texas Watercraft Owners

Boat insurance offers crucial protection for Texas boat owners, often saving them from financial disaster after accidents. Because Texas lakes and coastal areas are so active, accidents occur more often than many expect. Even experienced boaters can encounter collisions, weather damage, or theft while on the water. As a result, having boat insurance means you will not have to cover the full cost of repairs or liability yourself. Without coverage, even a small mishap could result in huge out-of-pocket expenses.

In Texas, liability is a major concern for anyone navigating busy waterways. If you accidentally damage another person’s boat or injure someone, liability insurance helps cover medical bills and repair costs. Moreover, Texas law may not require boat insurance, but marinas and lenders may require proof of coverage to use their facilities. Choosing to insure your boat means you can rest assured that you meet these requirements and avoid potential legal issues. When you protect yourself financially, you also protect your future boating adventures.

The weather in Texas can be unpredictable, and severe storms can strike with little warning. Strong winds, hail, and flooding have damaged many boats in the region each year. For that reason, boat insurance provides valuable support after natural disasters and can help get you back on the water quickly. With comprehensive coverage, you will not be left struggling to pay for costly repairs or replacement. Texas boat owners who value their investment find insurance essential for their peace of mind.

Types of Boat Insurance Options for Policies Available in Texas

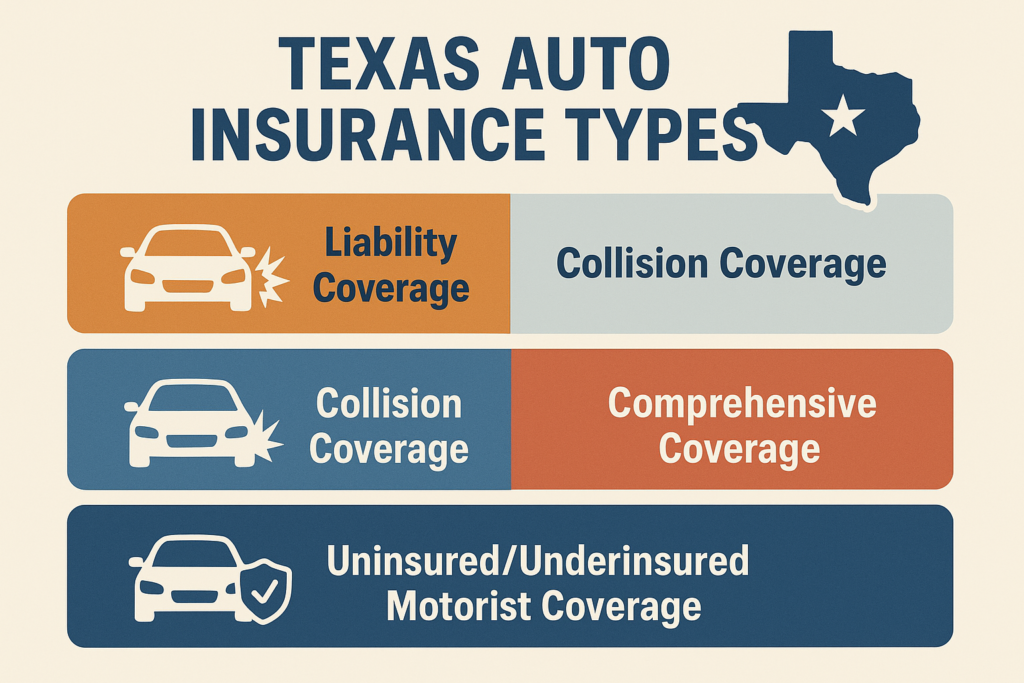

Texas boat owners can choose from several types of insurance policies to match their needs. The most basic type is liability insurance, which covers damage or injuries you cause to others while boating. While it does not cover your boat’s repairs, liability coverage is often required by marinas or lenders. Many boaters in Texas choose liability coverage as a foundation before adding additional coverage.

Comprehensive insurance offers broader coverage, giving peace of mind against theft, vandalism, fire, and weather-related damage. When you have comprehensive insurance, your boat is protected both in and out of the water. For valuable boats or those stored in risky locations, comprehensive plans make sense. Policies can also include protection for equipment, personal items, and towing costs if your boat breaks down.

Some Texas insurers offer agreed-value and actual-cash-value policies, which determine how much you receive after a total loss. Agreed value coverage pays a predetermined amount, typically the amount you paid for the policy. Actual cash value policies account for depreciation and pay the amount your boat is worth at the time of loss. Many owners review both options to find the best fit for their budget and needs. Customizing your policy ensures you are not caught off guard by unexpected events.

Key Factors to Consider When Choosing Coverage

Before choosing a boat insurance policy in Texas, you should carefully assess your needs and risks. Factors such as your boat’s age, type, and value are critical to selecting the right policy. Larger or newer boats usually need more coverage due to higher repair and replacement costs. If you use your boat frequently or host guests, you may want higher liability limits. By considering every angle, you can avoid paying for unnecessary extras.

Where you use and store your boat makes a big difference in coverage needs. Boating on the Gulf Coast often involves greater weather risks than inland lakes. Storing your boat outside exposes it to theft or storm damage, while secure storage may reduce your premiums. Texas boat owners should always check if their policy covers damages both on and off the water. Some companies might offer discounts for safety courses or advanced security features.

Reading your policy thoroughly also helps you avoid surprises after an accident. Be sure your coverage includes towing, salvage, and uninsured boater protection if needed. Sometimes a policy may not cover racing or business use of your boat, so check all exclusions. If you own expensive gear or electronics, ask your insurer about additional personal property coverage. By comparing quotes and asking questions, you find a policy that fits your lifestyle and budget.

Tips for Saving Money on Your Texas Boat Insurance

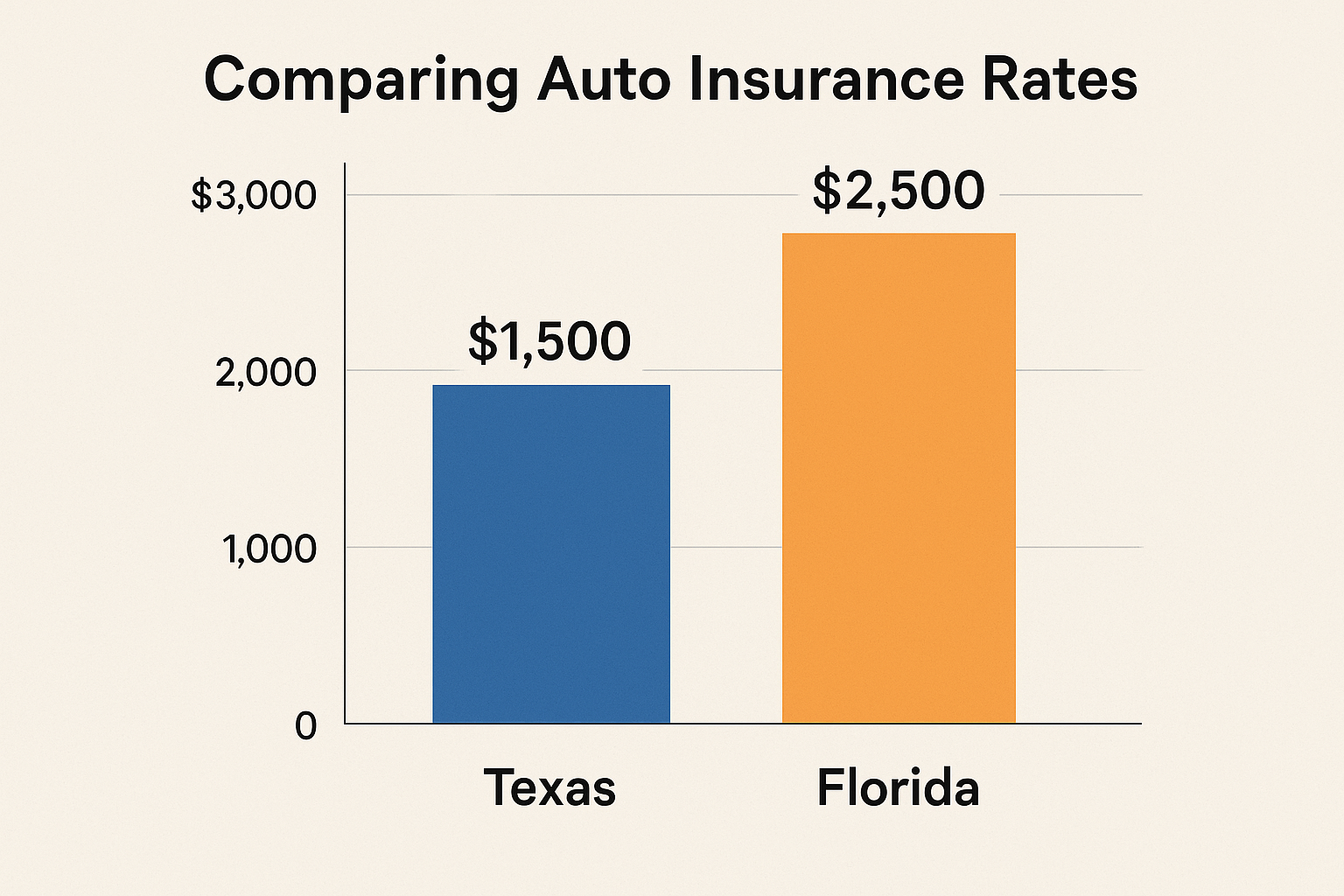

Finding affordable boat insurance in Texas requires some research and planning. Comparing quotes from several insurers helps you spot the best deals and identify coverage differences. You can also save money by choosing a higher deductible, which lowers your monthly premiums. Many Texas boat owners ask their current auto or home insurance provider about multi-policy discounts. Bundling your coverage often leads to significant savings.

Maintaining a clean boating record also reduces your insurance costs over time. Safe boating habits mean fewer claims, which insurers reward through lower rates. Insurers may offer discounts if you complete a safety course from an accredited provider like the US Coast Guard. Installing anti-theft devices, alarms, or GPS trackers on your boat can decrease your risk profile. Texas insurers may lower your premiums through proactive steps.

Reviewing your policy each year also ensures you are not paying for unnecessary extras. If your boat’s value decreases or you use it less frequently, you may qualify for a lower premium. Many boat owners in Texas adjust their coverage when their boating habits change. Shopping around at each renewal period helps you avoid missing out on new discounts or special offers. Taking a little time each year can add up to big savings over the long run.

Conclusion

Boat insurance in Texas is more than just a smart financial decision; it is essential for anyone who wants to protect their watercraft and enjoy boating with confidence. With so many lakes, rivers, and coastal waters, Texans face unique risks from both nature and crowded waterways. By understanding the different types of policies available, you can tailor your coverage to fit your boat, usage, and storage needs. Considering key factors such as boat value, location, and personal property further ensures you are not caught off guard by costly surprises. Saving money on your premium often comes down to safe boating, smart shopping, and regularly reviewing your policy for new discounts.